Will Trump Halt, Hinder or Accelerate China’s March in the Global Chemical Race?

Why does this matter?

Chemicals are, in aggregate, economically valuable. The country that masters non-fossil fuel chemical production will prosper.

The technologies for chemical transitions have a wide array of applications beyond chemicals which will probably end up being higher value

Many chemicals are essential to critical and emerging technology production. The transition provides the opportunity to remake chemical supply chains

China now looks best positioned to do that remaking

Let’s face it, the chemical trade is boring. Tetramethylammonium hydroxide hardly rolls off the tongue. But it is commonly used to etch the surface of silicon wafers for semiconductors. Your phone, AI data centres and electric vehicles need it for manufacture.

So, while it might be boring. The chemical industry is big, dirty and bloody important.

The global chemical industry makes an estimated $5.7 trillion contribution to the world economy which is equivalent to 7% of GDP. The expectation is that global chemical production will continue to expand.

They are in everything. The world would starve without nitrogen, potassium and phosphate fertilisers. All weapons and strategic technology relies on chemicals. Of course, it is a hugely diverse industry with hundreds of thousands of chemical types in production globally, and thousands of new substances developed every year.

And chemicals are ripe for disruption. Chemicals are typically converted from fossil fuels (or their derivatives) in highly polluting processes that are hard to alternatively recreate in a manner that is both cost-efficient and environmentally friendly.

This leads to two trends:

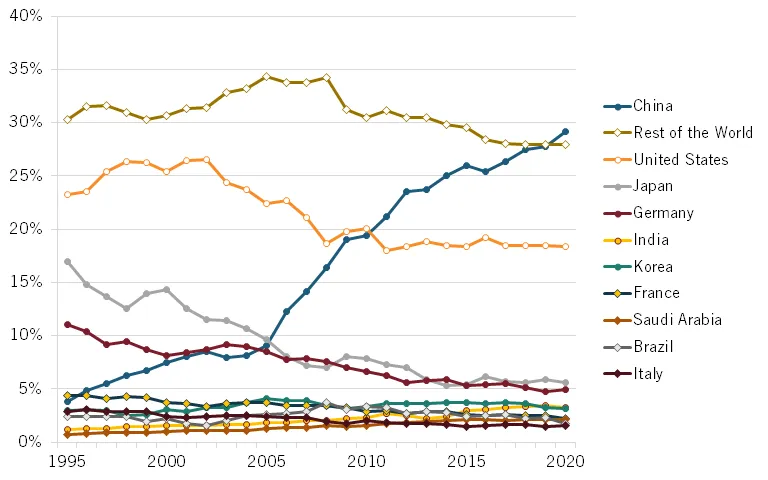

China has steadily increased its market share of traditional global chemical value-add to nearly 30% with the US second at about 18%.

A race is ongoing for alternatives such as biological processes. This looks like it will be stalled in the US by Trump while China is doubling down.

The battle to lead in traditional chemical production

As with so many other industries, China began to manufacture cheap low-end chemicals in 90s and started to dominate those sectors in the 2000s. But the high-end specialty stuff was still manufactured elsewhere.

As China began to dominate high-end manufacturing, high-end chemical leadership has followed. And as with many industries, China’s industrial model has led to rampant overcapacity in certain chemical sectors. As the graph below shows, China has steadily taken market share away from other countries and is now easily the largest single country chemical producer.

Top 10 producers’ historical shares of global value-added output in chemicals

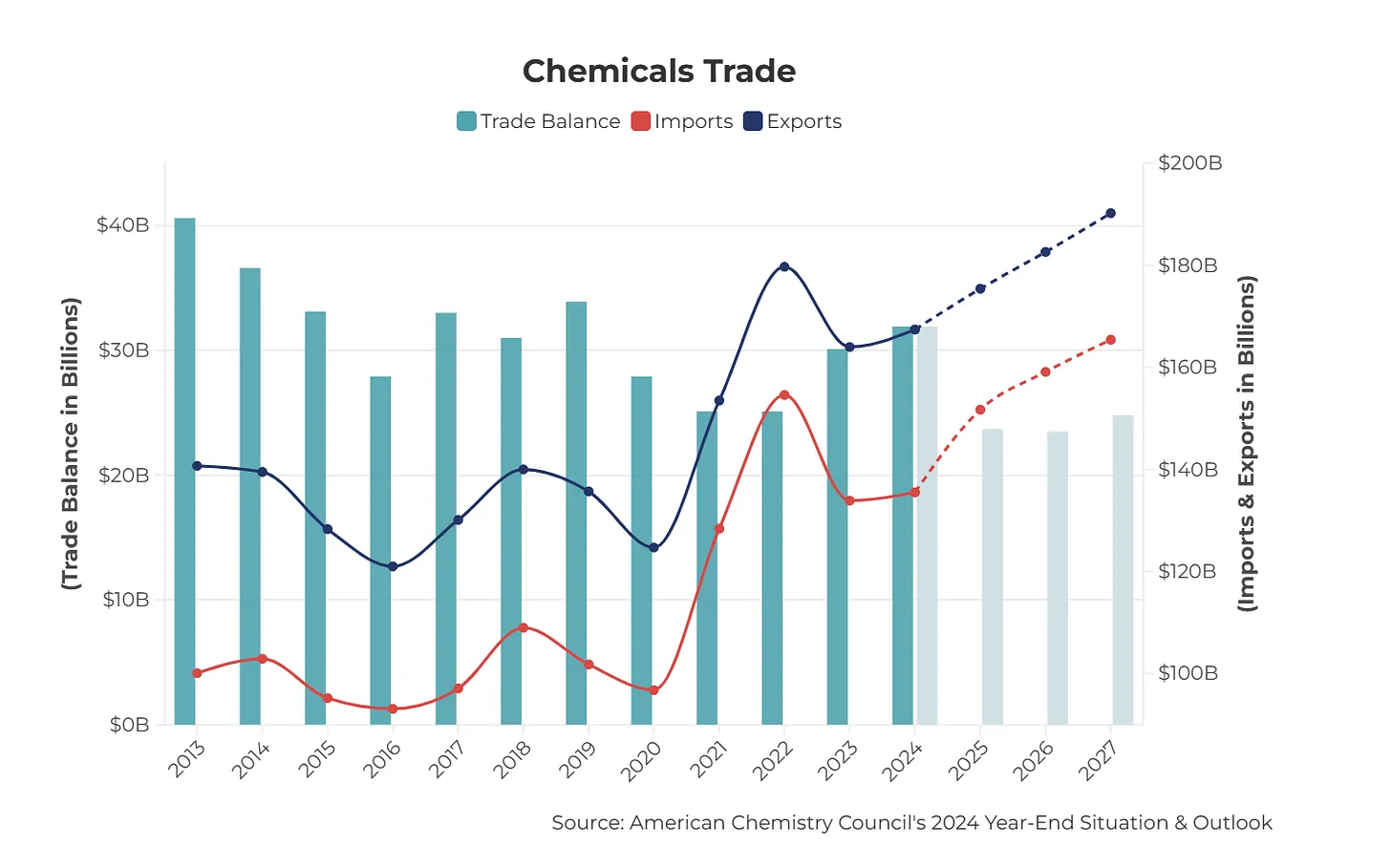

Unlike other industries, the US maintained its chemical production share, in part due to its access to feedstock because the US is the largest oil producer in the world. Perhaps more important, for Trump, the US is a net-exporter of chemicals.

The reason the US is a net exporter is because the Asia-Pacific accounts for 63% of global sales (servicing all that high-end manufacturing in China, Japan, Taiwan, Korea, Vietnam and India) and North America only accounts for 12%.

So what about Trump? As the Wall Street Journal points out, many tech companies (incl Chinese companies) are pursuing an anywhere but China strategy which has been accelerated by fears of further Trump tariffs.

But traditional chemical production does not occupy the same technological heights as say semiconductors, and chemicals tend to be high-volume low margin. The costs of a more expensive country for production can completely eat the profitability of a company.

The world’s biggest chemical company, BASF (from Germany), is doubling down on China with its largest ever overseas investment currently under construction in Zhanjiang. They claim most of their expanded production is to be sold in China. If China’s global share of manufacturing continues to rise and its production base remains cheaper than the rest of the world, then traditional chemical manufacturers will be strongly tempted to maintain large presences in the country, regardless of geopolitics. In fact, for selling to Chinese manufacturers, Chinese production will be necessary.

The Biomanufacturing Alternative

Researchers have been working for a long time to develop alternatives to hydrocarbon feedstocks for chemicals. There are plenty of alternative routes to final products, but only a small percentage have proven economically viable.

The economic failure of alternatives is because fossil fuels are cheap, easy to transport, have high energy density, and the processes for chemical refining have been perfected over a century. And, to be honest, fossil fuels are subsidised in many parts of the world. So, they are hard to displace.

One of the most interesting technologies is developing microbes that consume feedstocks such as sugar, agricultural offcuts, gases (like CO2), other biomass like algae or seaweed. Then those microbes will produce a target chemical. You then need to grow a lot of this organism. This process is called microbial fermentation.

There has been a good sprinkling (see Table 11 on page 39 of this report) of economically viable chemicals produced via microbial fermentation. But it is well short of the hundreds of thousands of currently commercially produced chemicals.

This technology has become increasingly viable because genetic engineering of the microbes continues to get easier as CRISPR technologies update; because of a vastly enhanced understanding of all parts of biology; AI has sped up the development of new genetically engineered microbes; And large scale fermentation techniques are improving.

The Biden admin got this.

Biden signed Executive Order 14081, which aimed to unite multiple government departments towards biomanufacturing.

The US DoD has its Biomanufacturing Strategy. The Department of Energy developed its own response to the executive order. Defence established the Distributed Bioindustrial Manufacturing Program (DBMP) to create essential military chemicals via bioprocesses. Defence also created BioMADE which is jointly funded by industry and government to establish a network of commercial and scale-up facilities across the country. The Inflation Reduction Act also allows for the funding of biomanufacturing. This is probably the most coordinated industrial plan the US has seen in decades.

CEO of BioMADE Douglas Friendman (starting from 17:35) contends this is about current chemical supply chains and also development of products that are advantaged by biology (think of self-regenerating airfields using concrete filled with bacteria, or armour that takes advantage of genetically engineered spider silk).

Trump’s response so far has been radio silence on biomanufacturing. There is no evidence that he intentionally plans to dismantle the system. But he has also not prioritised it. That is the same as a de-prioritization.

At a more functional level, Trump is rhetorically in support of fossil fuels which are direct competitors to alternate chemicals. He has been firing people in government departments like the Department of Energy and Agriculture which are central to the plan. What we could see is chaotic bouncing around with a lack of clarity for investors.

Conversely, China is all in on biomanufacturing as a long-term prospect. Their approach has been different. The central govt has set it as a clear priority. Provinces take this as a clear message to mobilise funds in that direction. In many cases, Chinese provinces will create competitor biomanufacturing companies to each other. The US BioMADE project alternatively is centrally directed in negotiation with states in an attempt to avoid duplication.

China is also prioritising the science of biomanufacturing. Numerous Chinese cities are building industrial-scale scientific centres for biomanufacturing or synthetic biology. This is despite the current cash crunch for technology investment in China.

In the US, the feeling is the science is most of the way there, and it is scale-up that needs work, which is the role of BioMADE.

Given that leadership in this technology will require stable long-term government support (very much like batteries, EVs, solar, wind and semiconductors before it), we are in a scenario that China seems to have got itself into a more clear position for leadership on biomanufacturing, and for replacing fossil fuel chemicals. That was not entirely clear pre-Trump.